do you pay sales tax on a leased car in california

Hi I have looked thoroughly here and this topic has not been discussed. Do you pay sales tax on a leased car in California.

Texas Car Sales Tax Everything You Need To Know

For example if your local sales tax rate is 5 simply multiply your monthly lease payment by 5 and add it to the payment amount to get your total payment figure.

. The dealership is telling me that I will need to pay sales. At the very least you have likely already paid at least some sales tax on the car so its highly unlikely you need to pay taxes on the complete original price of the leased car. Instead sales tax will be added to each monthly lease payment.

In this way only the buyer will pay sales tax when the car is re-registered. At the End of Your Lease Motor Vehicle Sales and Use Tax MVSUT will be assessed based on the residual value paid by the lessee to the lessor unless the lessee is exempt see below. No sales or use tax is due with respect to the rentals charged for tangible personal property leased in substantially the same form as acquired by the lessor or by his or her transferor as to which the lessor or transferor has paid sales tax reimbursement or has paid use tax measured by the purchase price.

However when the lessee is not subject to use tax then sales tax on the lessor applies except with leases to the United States Government which are exempt. Of this 125 percent goes to. In some states such as Oregon and New Hampshire theres no sales tax at all.

Plates may be transferred if agreed to by the lessor. Some might tax the full amount of the vehicle while others may only levy a sales tax on the depreciation youre paying during the lease term. Answer 1 of 4.

In addition the vessel must be leased in substantially the same form as acquired. Do you have to pay sales tax on a leased car in California. Sells the vehicle within 10 days use tax is due only from the third party.

While Californias sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. You may also have to pay an acquisition fee to the bank and a down payment called a cap reduction fee During the lease you pay your monthly payment insurance premiums ongoing maintenance costs and annual vehicle registration fees. What you pay and when you pay varies.

Do you pay sales tax on a leased car in Virginia. If the transaction takes longer than ten days the seller documents the odometer reading at the beginning of the process the odometer at the actual sale with an. You made a timely election to report and pay use tax measured by the purchase price.

In CA you are allowed to payoff your leased car in order to resell it without paying taxes on the payoff IF you can sell it back and to a third party which. Sells the vehicle after 10 days use. California Sales Tax on Car Purchases According to the Sales Tax Handbook the California sales tax for vehicles is 75 percent.

California collects a 75 state sales tax rate on the purchase of all vehicles of which 125 is allocated to county governments. This means you only pay tax on the part of the car you lease not the entire value of the car. Use tax is due.

Check the details with your states revenue department to understand your tax obligation and avoid any surprises when you sign the paperwork. Some states may charge sales tax on any down payment you make for your car lease. When you lease a car in most states you do not pay sales tax on the price or value of the car.

Remember automobile sales tax is collected by the DMV on behalf the tax authorities in California. In some places youll have to pay sales or excise tax on the amount you put down plus your monthly payments. The most common method is to tax monthly lease payments at the local sales tax rate.

For vehicles that are being rented or leased see see taxation of leases and rentals. Taxes and Registration for Leasing a Car. The 10 day window is the easiest way to execute the transaction with the DMV.

In CA you are allowed to payoff your leased car in order to resell it without paying taxes on the payoff IF you can sell it back and to a third. Depending on where you live leasing a car can trigger different tax consequences. With a lease you dont pay the sales tax up front.

Calculating lease car tax is essential when considering a car lease as most advertised lease specials do not include tax in the lease paymentsBefore contacting a dealership you consider the true value of a car lease by adding sales tax to an advertised lease payment. You paid sales tax at the time you purchased the vessel or. Local governments such as districts and cities can collect.

There are two primary methods used to calculate tax on a car lease. This page describes the taxability of leases and rentals in California including motor vehicles and tangible media property. Dear Driving for Dollars My lease is almost up and I would like to purchase the car.

You just have to pay for licensing titling and registration. To learn more see a full list of taxable and tax-exempt items in California. Start the buyout process early to allow time to transfer the title and other documents to your name.

Varied State Tax Laws. Buys the vehicle at the end of the lease use tax is based on the balance owed at the time of lease pay-off. Excluded are fees or taxes paid to the state which have been included in the sales price of a motor vehicle.

You pay sales tax monthly based on the amount of your payment. You may also have to pay an acquisition fee to the bank and a down payment called a cap reduction fee During the lease you pay your monthly payment insurance premiums ongoing maintenance costs and annual vehicle registration fees. This page covers the most important aspects of Californias sales tax with respects to vehicle purchases.

With a lease you dont pay the sales tax up front. States require you to pay a sales tax on a leased vehicle. Lease payments are not subject to tax when the lessor or transferor has paid sales tax.

Same way its calculated in any other state- monthly payment multiplied by your state sales tax rate s the sales tax on the lease payment- On a lease you pay sales tax monthly not up front - so just take your base payment lets say 350 a month-. Generally transactions that qualify as exempt sales will also qualify as exempt leases. If your vehicle lease is subject to state sales tax how much you have to pay and when you must pay it will vary by state.

Hanley Investment Group Completes Sale Of Single Tenant Cvs In Houma Louisiana For 3 35 Million Investment Group Investing Cvs

Musk Calls Hydrogen Fuel Cells Stupid But Tech May Threaten Tesla

Total Loss California Leased Vehicles

Can I Buy A Car With A Credit Card Nerdwallet

Sublease Agreement Template Real Estate Forms Real Estate Forms Business Proposal Sample Agreement

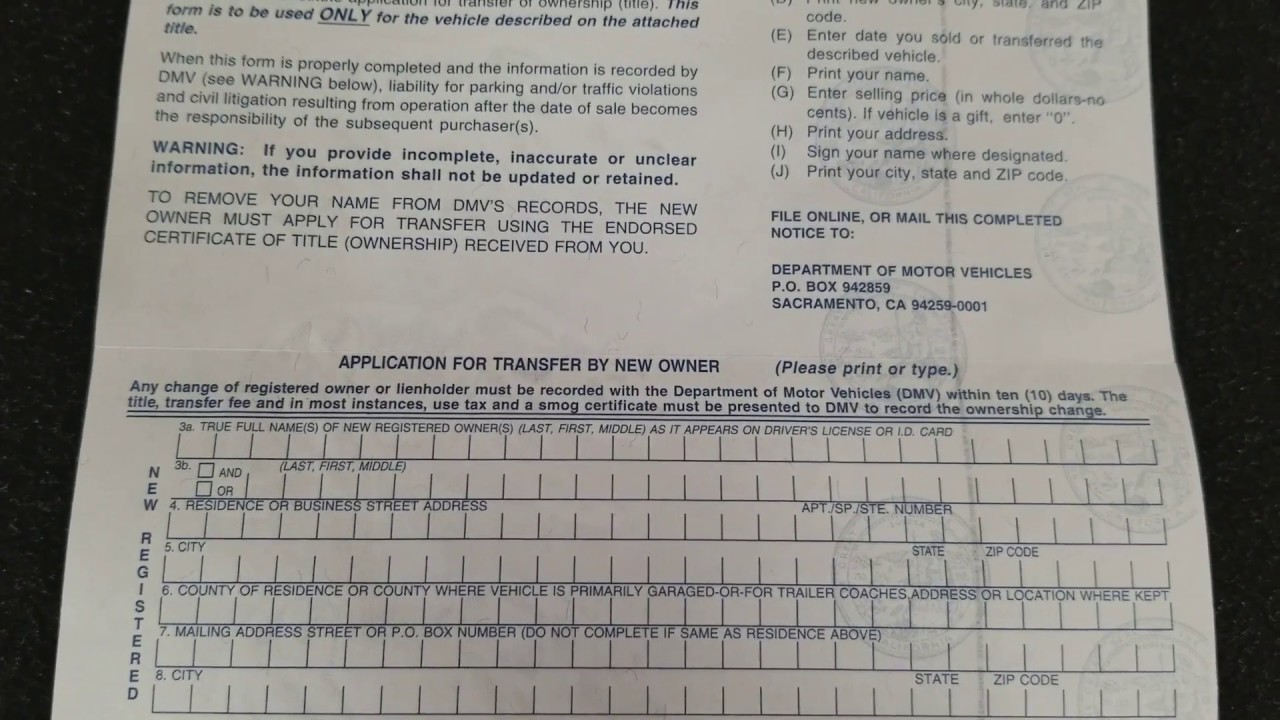

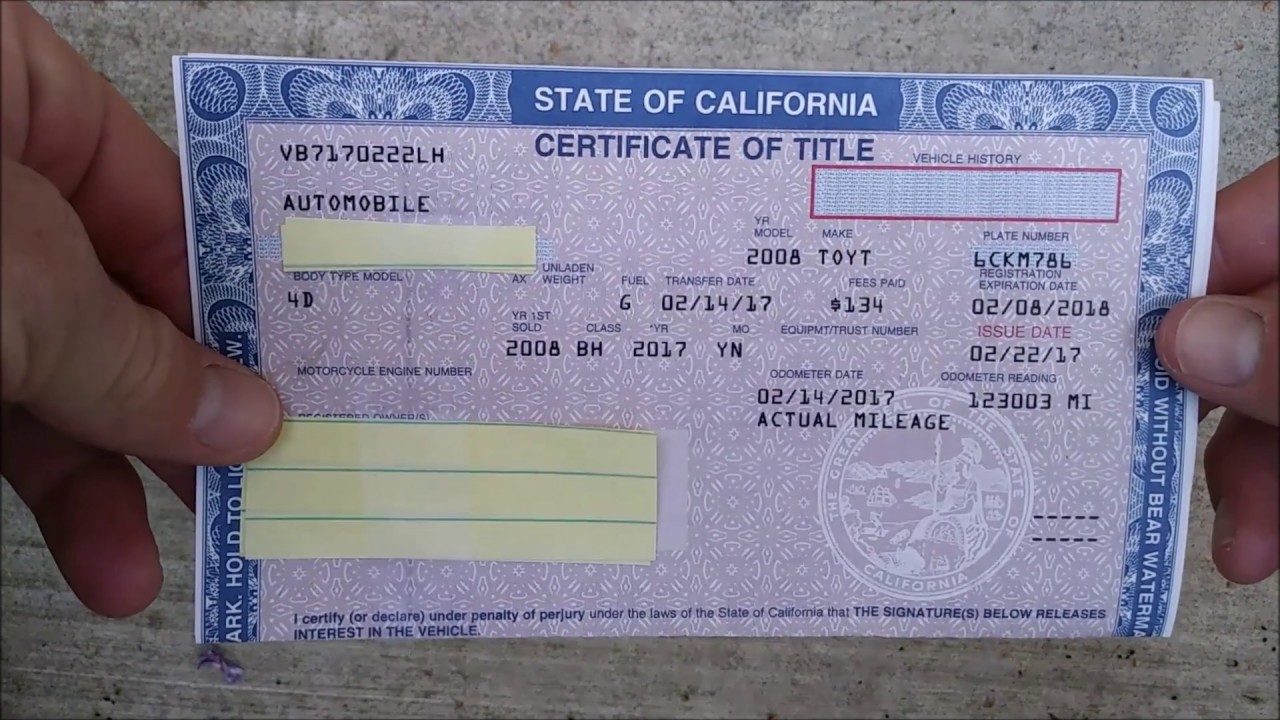

How To Fill Out A California Car Title In Detail Youtube

Why 75 Of Electric Car Buyers Don T Buy Electric Cars

Nj Car Sales Tax Everything You Need To Know

Which U S States Charge Property Taxes For Cars Mansion Global

How To Fill Out A California Car Title In Detail Youtube

How To Fill Out A California Car Title In Detail Youtube

California Car Buyer S Bill Of Rights Consumer Business

Pagani Zonda F Pagani Zonda Pagani Modified Cars

Why 75 Of Electric Car Buyers Don T Buy Electric Cars

2021 Volvo Xc40 T4 Fwd R Design Ratings Pricing Reviews Awards

2 Reits To Avoid And 1 Strong Buy Seeking Alpha Marketing Market Research Research Report